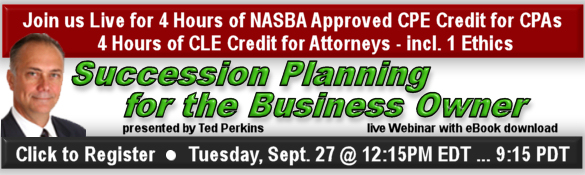

During this four hour CPE and CLE course (including 1 Hour of Ethics credit), firm partner Edward L. Perkins JD, LLM (Tax), CPA will discuss the smooth transfer of a business, with a focus on the succession planning process.

- Developing the Succession Estate Plan

- Determining What the Business is Really Worth

- Sale or Transfer Options Including Lifetime Gifts, Testamentary Transfers, Third Party Sale, and Related Party Sales, Charitable Bailouts

- Addressing Incapacity Issues

- Managing the Business in an Estate or Trust

- Paying the Estate Tax

Registration and more information is available by clicking HERE: